Update on Legal Complaint for Injunctive Relief

Summary – In 2021, JCV filed a Legal Complaint for...

Excerpt from August 4th, 2017 Journal News by Tim Cook

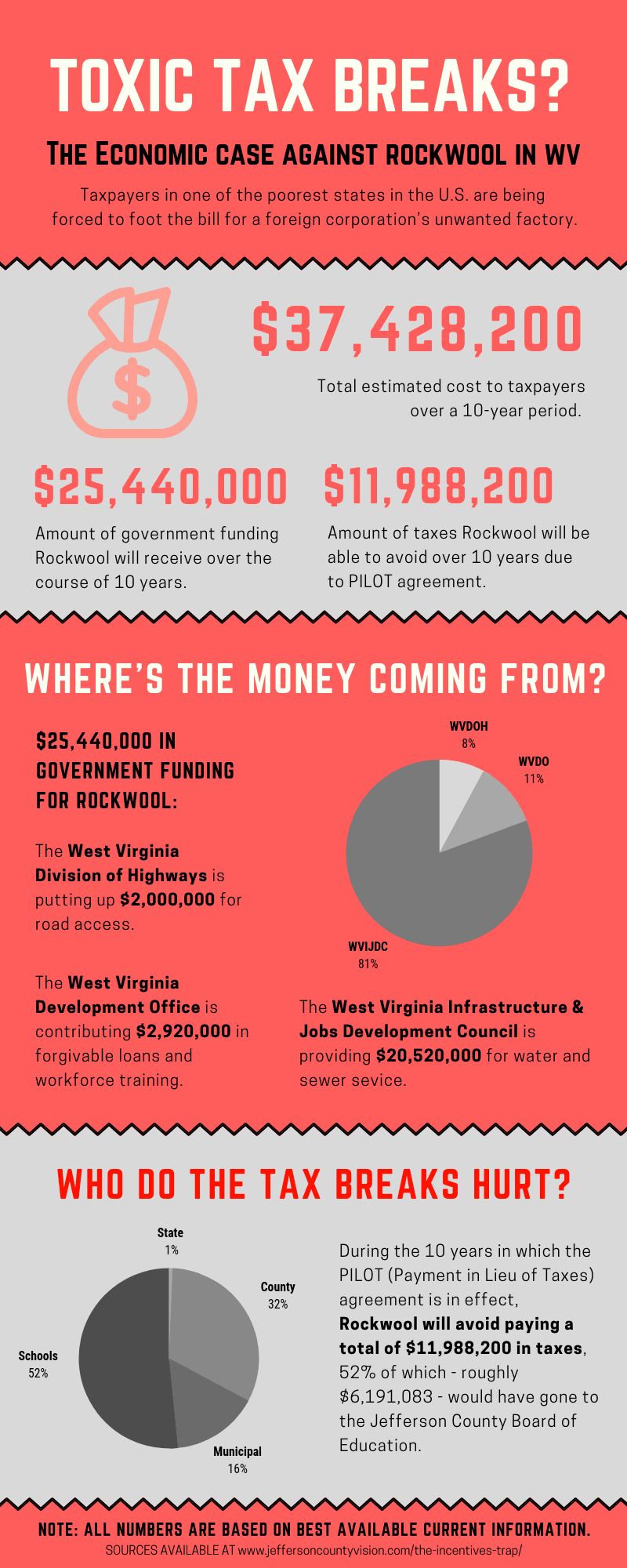

The “payment in lieu of taxes” agreement (PILOT) will allow Roxul Inc. to either completely or partially avoid paying local real estate or personal property taxes from 2018 through 2029.

“There have been so many lawyers looking at this (agreement) that my head is spinning,” said John Reisenweber, executive director of Jefferson County Economic Development Authority, who presented the agreement to commissioners. “So it’s had a lot of legal review.”

Under the terms of the so-called PILOT tax “abatement” agreement that the commissioners approved, Roxul’s county and municipal tax relief — which does not include other tax-relief incentives and about $15 million in infrastructure spending by West Virginia Department of Commerce officials — involves 130 acres of land that the company is purchasing for about $75 million at the 400-acre Jefferson Orchards site beside Route 9 in Ranson, Reisenweber said.

The PILOT agreement’s personal property tax relief for Roxul involves taxes that would be assessed on about $75 million worth of manufacturing equipment the company will initially purchase to open and operate its 463,000-square-foot plant stating in 2020.

The Ranson City Council approved the same PILOT agreement last month, accepting the terms under which the city will forgo its share of local real estate and property tax payments that Roxul won’t not be paying.

Roxul plans to start manufacturing residential and commercial insulation products at the Ranson site starting in 2020 with about 120 to 150 employees.

https://www.facebook.com/emma.huvos/videos/10213030151128795/

Note from Emma:

Today I’m digging in to Jefferson County Vision‘s “Toxic Tax Breaks” infographic to make sense of where the numbers came from and what they mean for our community. I encourage you to look in to the information yourself and see what conclusions you reach.

Summary – In 2021, JCV filed a Legal Complaint for...

Our Pickin’ on Polluters VI fundraiser co-hosted by...

JCV has entered its fifth year of serving the community. A...

© 2024 Jefferson County Vision, Inc.